The costs of keeping your vehicle properly maintained and repaired can quickly add up. With some repairs costing thousands of dollars, these expenses take a major bite out of your budget. To recoup some of these costs, claiming eligible car expenses as itemized tax deductions can provide substantial savings. This guide will cover everything you need to know about car repair tax deductions and maintenance on your tax return. Are car repairs tax deductible- let’s find out together!

We’ll outline which auto-related costs you can claim, the documentation required, how to determine if you should itemize, and limitations on car repair deductions. Our goal is to ensure you maximize qualifying vehicle expenses on your taxes through proper record-keeping and reporting. Let’s get rolling.

Should You Itemize or Take the Standard Deduction?

The first question when preparing to deduct car expenses is whether you’ll itemize your tax deductions or take the standard deduction. You must itemize to claim miscellaneous deductions like car repairs and maintenance. Very few taxpayers have sufficient itemized deductions to exceed the standard amounts:

- Single Filer Standard Deduction – $12,950

- Married Filing Jointly – $25,900

- Head of Household – $19,400

So tally up your potential itemized deductions for aspects like mortgage interest, state taxes, and charitable contributions. Also track your total auto repair and maintenance costs for the year.

If your total itemized deductions don’t reasonably exceed the standard deduction amount you qualify for, then sticking with the standard deduction makes sense. But if you have significant expenses to write off, itemizing saves more money.

Tally Auto Expenses to Determine Best Option

Log every auto expense throughout the year – both repairs and maintenance like oil changes. Tracking expenses is also helpful for budgeting. Capture these details:

- Date and description of each automotive service and repair

- Mileage at the time of the service

- Cost of parts and labor

Add up expenses at year end. If your total provides substantial tax savings beyond the standard deduction, itemizing makes sense. Deductions every year going forward also make it worthwhile.

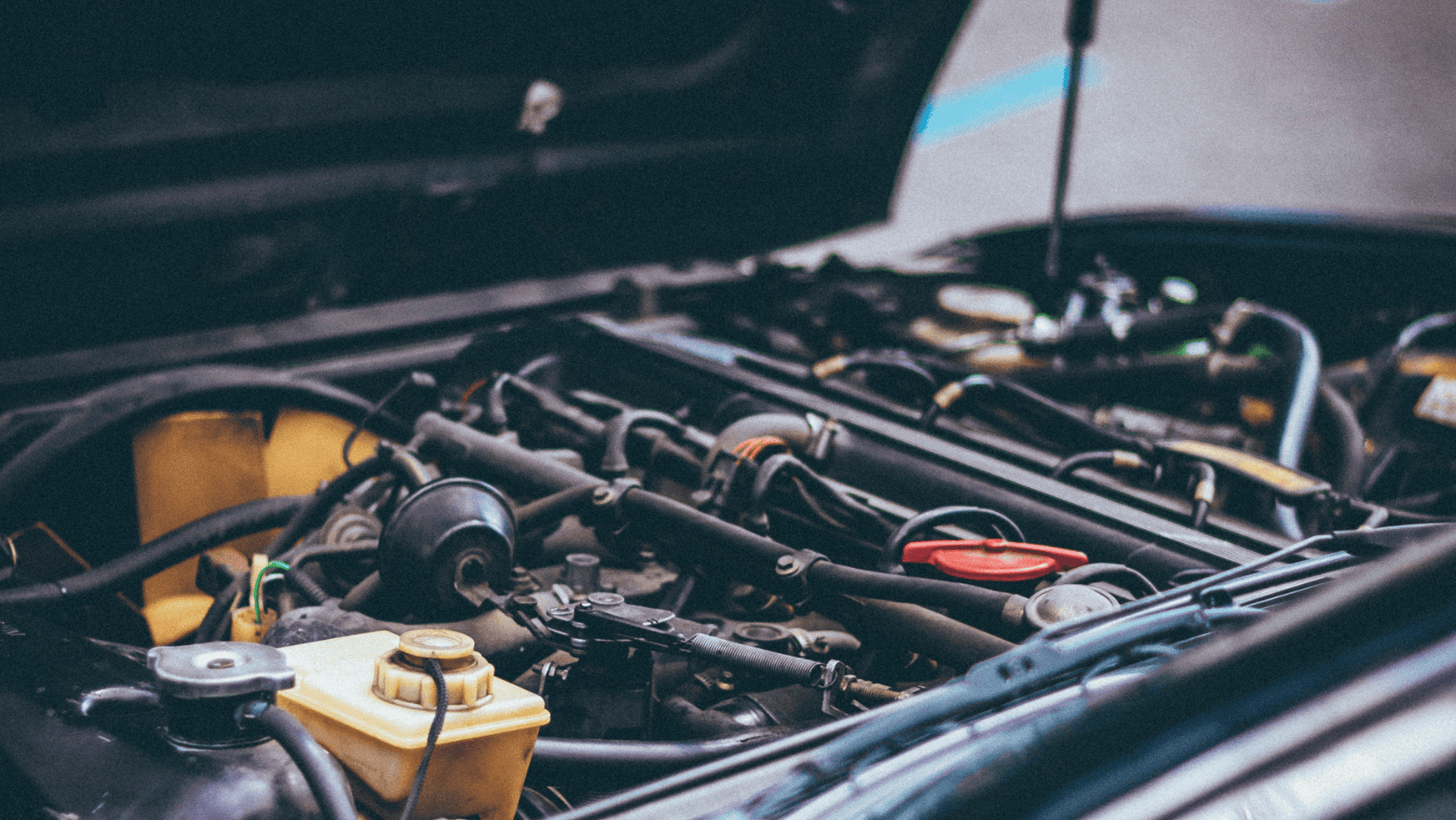

Car Repair and Maintenance Costs You Can Deduct

Generally, any costs directly related to the operation and routine repair of your vehicle potentially qualify as deductible expenses. Common examples include:

- Parts and labor for scheduled maintenance like brake services, tune-ups, timing belt replacement, etc.

- Unexpected critical repairs like transmission rebuilds, valve jobs, head gasket replacement, etc.

- diagnoses related to identifying and resolving mechanical issues

- Towing to the repair facility when required for a qualifying repair

- Consumables and fluids like oil changes, antifreeze, transmission fluid, brake pads, etc.

- Wheel alignments and tire rotations to maintain even treadwear

- Storage fees when required as part of repairs

- Cleaning expenses if required to perform a deductible repair like engine degreasing

Ineligible Vehicle Expenses

Several auto-related costs don’t qualify for deductions. These include:

- Vehicle registration and licensing fees

- Insurance premiums

- Loan interest or lease payments

- Routine cleaning like car washes or detailing

- Fuel costs, EV charging

- Parking costs and tolls

- Add-on accessories like fancy stereos

- Cosmetic enhancements like paint jobs, upholstery

Stick to claiming operating, maintenance, and repair expenses directly related to vehicle safety and function.

Reporting Car Repair Expenses on Your Tax Return

Claiming your deductible car costs takes just a couple quick steps when filing:

- Report auto repair expenses on Schedule A, Itemized Deductions

- For unreimbursed employee vehicle costs, claim deductions on Form 2106, Employee Business Expenses

All repair receipts, invoices, and mileage logs serve as supporting evidence for your claimed deductions. Retain documentation for at least 3 years in the event of audit.

Qualifying car repairs fall under the category of “miscellaneous itemized deductions” subject to some limitations we’ll explain shortly. But properly documenting your expenses ensures you maximize write-offs permitted.

Unreimbursed Employee Vehicle Expenses

For any repair or maintenance costs related to vehicles used for business purposes, special rules apply:

- Expenses must relate to the percentage of miles driven for business usage. Commuting and personal miles don’t qualify.

- Log business miles driven and keep detailed records attributing specific costs to business usage.

- Fill out Form 2106, Employee Business Expenses when filing to report qualified unreimbursed employee vehicle costs.

Thorough mileage tracking provides justification for claiming only the business portion of total vehicle expenses.

Limitations and Phase-Outs on Car Repair Tax Deductions

While deducting auto repairs and maintenance provides substantial tax savings, be aware of certain limitations:

- The total of all miscellaneous itemized deductions is only deductible to the extent it exceeds 2% of your adjusted gross income (AGI)

- For higher income earners over certain thresholds, total itemized deductions including car repairs get phased out or eliminated by 3% of the amount your income exceeds the thresholds

These thresholds and phase outs mean very high earners deduct fewer auto expenses. But for most taxpayers tracking car costs diligently still yields significant savings.

Strategies for Maximizing Car Repair Tax Deductions

Follow these tips to make the most of deducting your auto maintenance and repairs:

- Bundle repairs and maintenance when possible into one year instead of splitting over two years to exceed the 2% AGI threshold

- Review expenses annually to determine if better to take the standard deduction or itemize

- If close to AGI phase-out thresholds, consider strategies to manage AGI like 401k contributions

- For business vehicles, accurately categorize between deductible business vs non-deductible personal miles driven

- Consult a savvy accountant or tax preparer for guidance on maximizing deductions

Can Sales Tax be Claimed on Repairs?

If you reside in a state that charges sales tax on auto repair labor, these taxes are also deductible provided you itemize and claim state sales tax instead of state income tax. Retain invoices showing labor taxes paid.

The Takeaway on Car Repair Tax Deductions

Diligent tracking of your vehicle expenses throughout the year can yield substantial tax savings when you itemize deductions. Any costs tied directly to the safety and operating condition of your car potentially qualify. But understanding the limitations and proper tax forms is key to maximize what the IRS allows.

While deductions won’t erase the costly sting of major repairs, detailed documentation provides partial reimbursement making breakdowns a little less painful. Consult a knowledgeable accountant or tax preparer to ensure you don’t leave any potential savings on the table.

Now with some basic guidance on deducting your wheels on your taxes, you can roll into tax time confident that Uncle Sam will at least pitch in a bit for the cost of keeping your ride running smoothly all year.